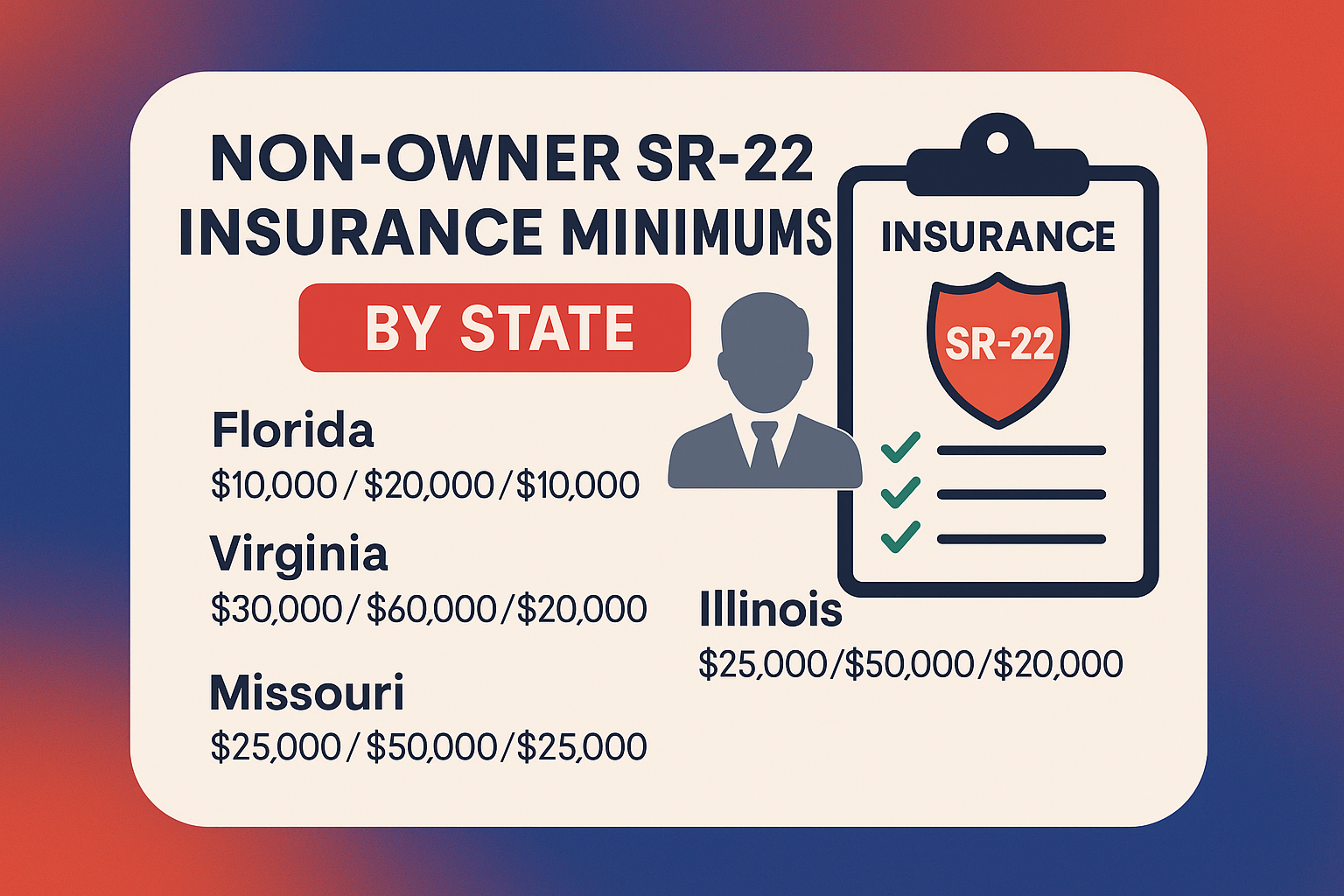

Every state sets its own rules for SR-22 filings (and in some cases, FR-44). How long you keep it, what liability minimums apply, and what happens if you lapse varies. Below are the 2025 requirements for the nine states The Car Insurance Guy covers.

Quick refresher: An SR-22 or FR-44 is not insurance. It’s a state filing proving you carry the required liability coverage.

Florida (SR-22 & FR-44)

- Minimums: PIP $10,000 and PDL $10,000. FR-44 (DUI cases) requires 100/300/50 liability.

- Duration: Usually 3 years.

- Triggers: DUI, driving without insurance, excessive points, or serious at-fault accidents.

- Lapse consequences: Policy cancellation → immediate license suspension. The 3-year clock resets.

Resource: Florida Highway Safety & Motor Vehicles

Virginia (SR-22 & FR-44)

- Minimums (2025): 50/100/25. FR-44 (DUI) doubles this to 100/200/50.

- Duration: Commonly 3 years.

- Triggers: DUI, uninsured driving, refusal of breath test, reckless driving.

- Lapse consequences: DMV notified, license suspended, and reinstatement fees required.

Resource: Virginia DMV

Illinois

- Minimums: 25/50/20 liability.

- Duration: 3 years continuous coverage required.

- Triggers: DUI, uninsured crash, unsatisfied judgment, safety responsibility violations.

- Lapse consequences: SOS immediately suspends license and registration; clock resets.

Resource: Illinois Secretary of State

Missouri

- Minimums: 25/50/25 liability, UM 25/50 required.

- Duration: Generally 2–3 years.

- Triggers: Mandatory insurance violations, DUI, point suspensions, unpaid judgments.

- Lapse consequences: License revoked; reinstatement requires new filing and fees.

Resource: Missouri DOR

Texas

- Minimums: 30/60/25 liability.

- Duration: 2 years from conviction date.

- Triggers: DUI, uninsured driving, repeated violations, serious crashes.

- Lapse consequences: DPS suspends license and reinstatement fees apply.

Resource: Texas DPS

California

- Minimums (2025): 30/60/15 liability (up from 15/30/5 in 2024).

- Duration: Usually 3 years.

- Triggers: DUI, reckless driving, uninsured accidents, suspended license reinstatement.

- Lapse consequences: DMV suspends license; new filing required and timeline may restart.

Resource: California DMV

Arizona

- Minimums: 25/50/15 liability.

- Duration: Typically 3 years.

- Triggers: DUI, uninsured crash, points suspensions, unpaid judgments.

- Lapse consequences: MVD suspends license/registration until proof is re-filed.

Resource: Arizona DOT

Nevada

- Minimums: 25/50/20 liability.

- Duration: Usually 3 years.

- Triggers: DUI, uninsured driving, reckless driving, or repeat serious violations.

- Lapse consequences: DMV notifies and license suspended until coverage restored.

Resource: Nevada DOI

South Carolina

- Minimums: 25/50/25 liability; UM required at same limits.

- Duration: 3 years.

- Triggers: DUI, uninsured accidents, multiple violations, safety responsibility cases.

- Lapse consequences: Immediate license suspension and reinstatement fees required.

Resource: South Carolina DMV

Need SR-22 or FR-44 Help?

We file fast, track DMV acceptance, and keep your coverage active — so you don’t lose time or money.

© 2025 The Car Insurance Guy • Veteran-owned • Privacy